Which of the following statements about bonds is true everfi – In the realm of finance, bonds play a pivotal role, offering investors opportunities for capital growth and income generation. Understanding the intricacies of bonds is crucial for navigating the financial markets successfully. This comprehensive guide delves into the fundamental concepts of bonds, their characteristics, risks, returns, market dynamics, and investment strategies, empowering investors with the knowledge they need to make informed decisions.

Bond Characteristics: Which Of The Following Statements About Bonds Is True Everfi

Bonds are debt instruments that represent a loan made by an investor to a borrower, typically a corporation or government. They are issued by entities seeking to raise capital, with the promise to repay the principal amount at a specified maturity date and to pay interest payments at regular intervals until maturity.

Bonds play a crucial role in the financial market by facilitating capital formation and providing investors with a source of fixed income. They offer a range of maturity dates, interest rates, and credit ratings, allowing investors to tailor their investments to their risk tolerance and financial goals.

Types of Bonds, Which of the following statements about bonds is true everfi

- Corporate Bonds:Issued by corporations to raise capital for various purposes, such as expansion, acquisitions, or debt refinancing.

- Government Bonds:Issued by governments to finance public spending, infrastructure projects, or to manage national debt.

- Municipal Bonds:Issued by state and local governments to fund public projects, such as schools, roads, and hospitals.

- Agency Bonds:Issued by government-sponsored enterprises (GSEs) such as Fannie Mae and Freddie Mac, which support the housing market.

- Convertible Bonds:Hybrid securities that can be converted into shares of the issuing company’s stock at a specified price.

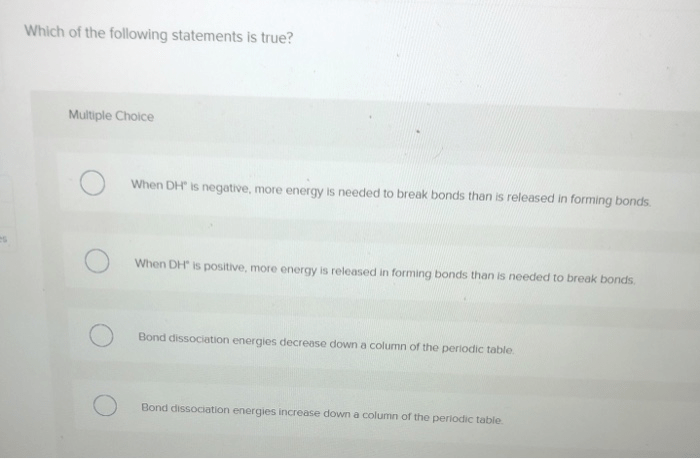

Factors Influencing Bond Prices and Yields

- Interest Rates:Rising interest rates generally lead to lower bond prices, as investors can obtain higher returns from new bonds with higher interest rates.

- Inflation:Inflation can erode the real value of bond returns, as the interest payments and principal repayment become less valuable over time.

- Credit Risk:The creditworthiness of the bond issuer influences its bond yield, as investors demand higher returns for bonds issued by borrowers with lower credit ratings.

- Supply and Demand:The supply and demand for bonds in the market can also affect their prices and yields.

Question Bank

What is a bond?

A bond is a type of fixed-income security that represents a loan made by an investor to a borrower, typically a corporation or government. The borrower agrees to pay the investor interest payments at regular intervals and repay the principal amount at the bond’s maturity date.

What are the different types of bonds?

There are various types of bonds, including corporate bonds, government bonds, municipal bonds, and international bonds. Each type has its own unique characteristics and risk-return profile.

How do bond prices and yields work?

Bond prices and yields move inversely. When bond prices rise, yields fall, and vice versa. Interest rates, inflation, and economic conditions are key factors that influence bond prices and yields.